What is Fiat Money?

The term, fiat money, is derived from the Latin word fiat, which means a determination by authority. Fiat money is a form of currency that is considered legal tender by a government and is not backed by a physical commodity or financial instrument. It includes paper money and coins, as well as money in the form of loans, bonds, and credit. 95% of all fiat money is not physical money. It’s mostly accounted for in bank and government ledgers. Examples of fiat money include the US dollar, the Euro, or the Japanese Yen.

Fiat money’s value is determined by the government and the stability of the nation’s economy rather than the material it is made of. After the U.S. abandoned the gold standard in 1971, fiat money became the norm. However, because it is not tied to gold, it is at risk of inflation and loses value as the government prints more money. Before 1971, the global economy operated on the gold standard, where individuals could exchange their money for a fixed amount of gold. Countries that followed the gold standard established a fixed price for gold, which was used to determine the value of their currency. This meant that the amount of money in circulation was directly linked to the country’s gold reserves. Now that the world is off the gold standard, governments can print money without any real value added to the economy.

Banks can also create more fiat money out of thin air. They do this through fractional reserve banking. This is where banks can loan out a significant portion of the money that people give to them. Watch this quick video to get an idea of how this contributes to inflation.

Today, governments try to keep the value of their money from diminishing by increasing interest rates among other tactics. This reduces the amount people will spend which creates the appearance that money is more scarce. In reality, people’s purchasing power is still decreasing which is how inflation steals wealth from those who have saved money. Keynesian economics would have you believe that inflation is a good thing because it promotes spending which helps promote and expand the economy. In reality, the economy is expanded by adding true value in the form of new technology, goods, and services. It is not magically expanded by increasing the money supply.

Increasing the money supply actually hurts the average person because it raises the price of goods disproportionately to how much more money they receive after an inflation event. This is because it takes time for newly created money to trickle down to the common person. When it is created, it goes first to the people who are closest to where the money is created. This money goes to people like high-ranking politicians and big companies. These people and companies get to spend this new money first, which means their purchasing power is much stronger compared to everyone else who didn’t receive this new money. This is known as the Cantillon effect. If you need more evidence of who gets most of the new money printed read here.

Here is a simplified analogy of the Cantillon effect. Imagine there are one million dollars in total circulation. A house costs one hundred dollars. Everyone is content with this price in comparison to how much money exists. Now, the government decides to print an extra half a million dollars. If all of this money was equally distributed, then everyone should now be happy with a house costing one hundred and fifty dollars. But instead what happens, is this money is only given to a select few people. For the time being, a house remains one hundred dollars, but the select few have this new money, so houses are extra cheap to them. They can buy as many houses as they want. This brings house prices up. All this extra spending of new money actually brings the price of houses up to two hundred dollars because that’s what the select few can afford. Eventually, this new money trickles down to the rest of the people, but by now houses are more expensive than they can afford. This leaves the select few with houses they got for cheap, and everyone else with prices of goods increased more than what the total new money supply would suggest. This is obviously an oversimplified analogy, but this is essentially what happens when a select few from the population get to spend new money before it is equally distributed to everyone.

Today, governments try to keep the value of their money from diminishing by increasing interest rates among other tactics. This reduces the amount people will spend which creates the appearance that money is more scarce. In reality, people’s purchasing power is still decreasing which is how inflation steals wealth from those who have saved money. Keynesian economics would have you believe that inflation is a good thing because it promotes spending which helps promote and expand the economy. In reality, the economy is expanded by adding true value in the form of new technology, goods, and services. It is not magically expanded by increasing the money supply.

Increasing the money supply actually hurts the average person because it raises the price of goods disproportionately to how much more money they receive after an inflation event. This is because it takes time for newly created money to trickle down to the common person. When it is created, it goes first to the people who are closest to where the money is created. This money goes to people like high-ranking politicians and big companies. These people and companies get to spend this new money first, which means their purchasing power is much stronger compared to everyone else who didn’t receive this new money. This is known as the Cantillon effect.

Here is a simplified analogy of the Cantillon effect. Imagine there are one million dollars in total circulation. A house costs one hundred dollars. Everyone is content with this price in comparison to how much money exists. Now, the government decides to print an extra half a million dollars. If all of this money was equally distributed, then everyone should now be happy with a house costing one hundred and fifty dollars. But instead what happens, is this money is only given to a select few people. For the time being, a house remains one hundred dollars, but the select few have this new money, so houses are extra cheap to them. They can buy as many houses as they want. This brings house prices up. All this extra spending of new money actually brings the price of houses up to two hundred dollars because that’s what the select few can afford. Eventually, this new money trickles down to the rest of the people, but by now houses are more expensive than they can afford. This leaves the select few with houses they got for cheap, and everyone else with prices of goods increased more than what the total new money supply would suggest. This is obviously an oversimplified analogy, but this is essentially what happens when a select few from the population get to spend new money before it is equally distributed to everyone.

How is Bitcoin Different?

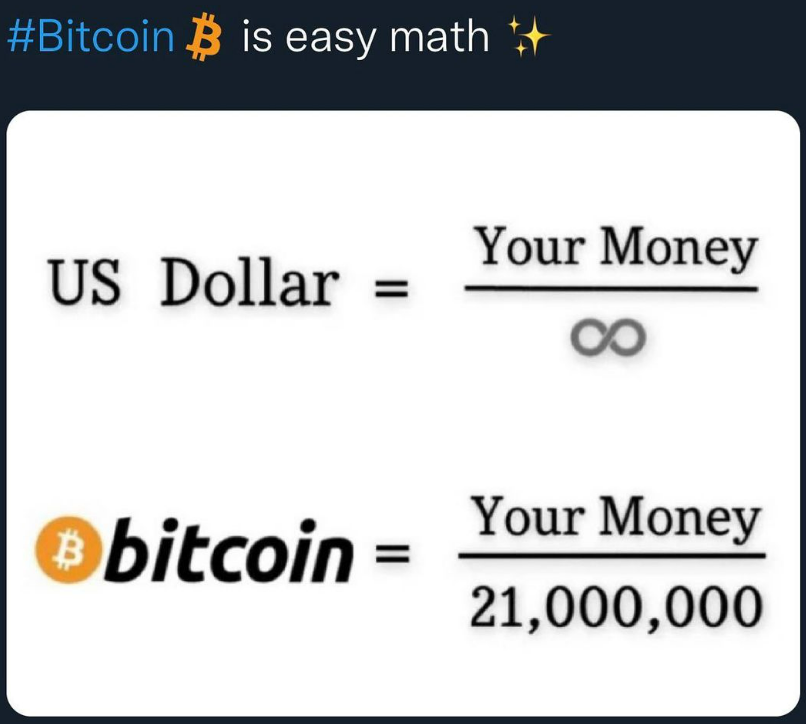

Bitcoin doesn’t have a government or a small group of people who get to make the rules. The value of Bitcoin is not determined by a government, it’s determined by everyone who chooses to buy or sell it. Bitcoin is much more similar to the gold standard than it is to fiat money. Gold requires work, specialized equipment, and energy to mine from the ground. There is a limited amount of gold in the Earth’s crust. To mine Bitcoin, one must have specialized computers which solve complicated mathematical problems. This process requires energy. There are only twenty-one million Bitcoin that will ever exist. Every four years, the amount of Bitcoin rewarded to these mining computers is cut in half. So in reality it’s becoming harder to make more Bitcoin.

Critics of Bitcoin argue that it isn’t backed by anything. They think that because it’s digital, it has no inherent value. They worry that because it isn’t controlled by a government, there is no one to defend it. Let’s respond to each of these three concerns separately.

What is Bitcoin backed by?

Bitcoin is backed by energy and cryptography. Energy is required to run the mining computers which are solving cryptography problems. Cryptography is the practice and study of techniques for secure communication in the presence of adversarial behavior. This is where the term “crypto” comes from. There are multiple types of cryptography, but the one Bitcoin mining is concerned with is called hash functions. Hash functions are irreversible, one-way functions which protect the data, at the cost of not being able to recover the original message. In the context of Bitcoin, a hash function is used to create a unique and fixed-size digital fingerprint of a larger block of data. This fingerprint, called a “hash,” is used to verify the integrity of the data and ensure that it has not been tampered with. In Bitcoin, hash functions are used in the mining process to secure the blockchain by including a hash of the previous block in each new block. Miners compete to find the solution to a complex mathematical problem, which involves finding a specific hash value that meets certain criteria. The miner who finds the solution gets to add the next block to the blockchain and is rewarded with newly minted Bitcoins. As mentioned, this process requires a significant amount of energy. This energy input is Bitcoin’s tether to real-world value. Without energy flowing into the Bitcoin network, it wouldn’t be secure and it wouldn’t have any real-world thing backing its value.

How can Bitcoin have value if it’s digital?

We just explained what Bitcoin is backed by in the section above. To dive deeper into this concern of Bitcoin being digital, I’d turn and ask the same question about the digital money that we keep stored on our debit cards. Some may answer that you can go to the bank and withdraw physical money. I’d then ask what this money is backed by and refer you to this very article. The irony of this initial question about Bitcoin being digital is that there is plenty of value for money being digital. This is why we spend money with debit cards in the first place. It’s extremely portable and can be sent around the world at nearly the speed of light. To answer this question, yes there is actually added value to money being digital by its nature. Gold had the problem of requiring trusted third parties such as governments and banks to store it safely. Governments could lie about how much gold they had in their vaults. With Bitcoin, anyone who runs their own node can personally verify how much Bitcoin exists at any given time. There is full transparency and accountability thanks to Bitcoin’s decentralized ledger.

Who is going to defend Bitcoin if it isn’t controlled by the government?

Bitcoin doesn’t need to be defended. Bitcoin isn’t trying to keep people out. Bitcoin isn’t waging a war against any other country. It’s a voluntary peer-to-peer network that offers a new way of storing and sending wealth. Bitcoin doesn’t change as the world changes. It just keeps doing its own thing, a plan set in motion by Satoshi Nakomoto over a decade ago. Bitcoin has had countries ban it along with countries who now accept it as legal tender. China at one point had the most “hash power” or amount of Bitcoin mining computing power compared to any other country. Then the Chinese government banned Bitcoin mining forcing all of those computers to shut down. Bitcoin continued on. Those mining computers found new places to run. People can leave China with their Bitcoin without the government even knowing. Even if they did know, they have no way of taking it without knowing the seed phrase for the wallet it’s stored on. Bitcoin doesn’t fight back when a country attacks it, it just goes elsewhere. It is completely voluntary for individuals to be a part of it, but it’s these individuals who are the ones defending Bitcoin. You defend Bitcoin by simply being a part of it. Bitcoin doesn’t need you to defend it, but it welcomes anyone who is looking for another option from the fiat standard we live in today.

Bitcoin vs. Fiat in Summary

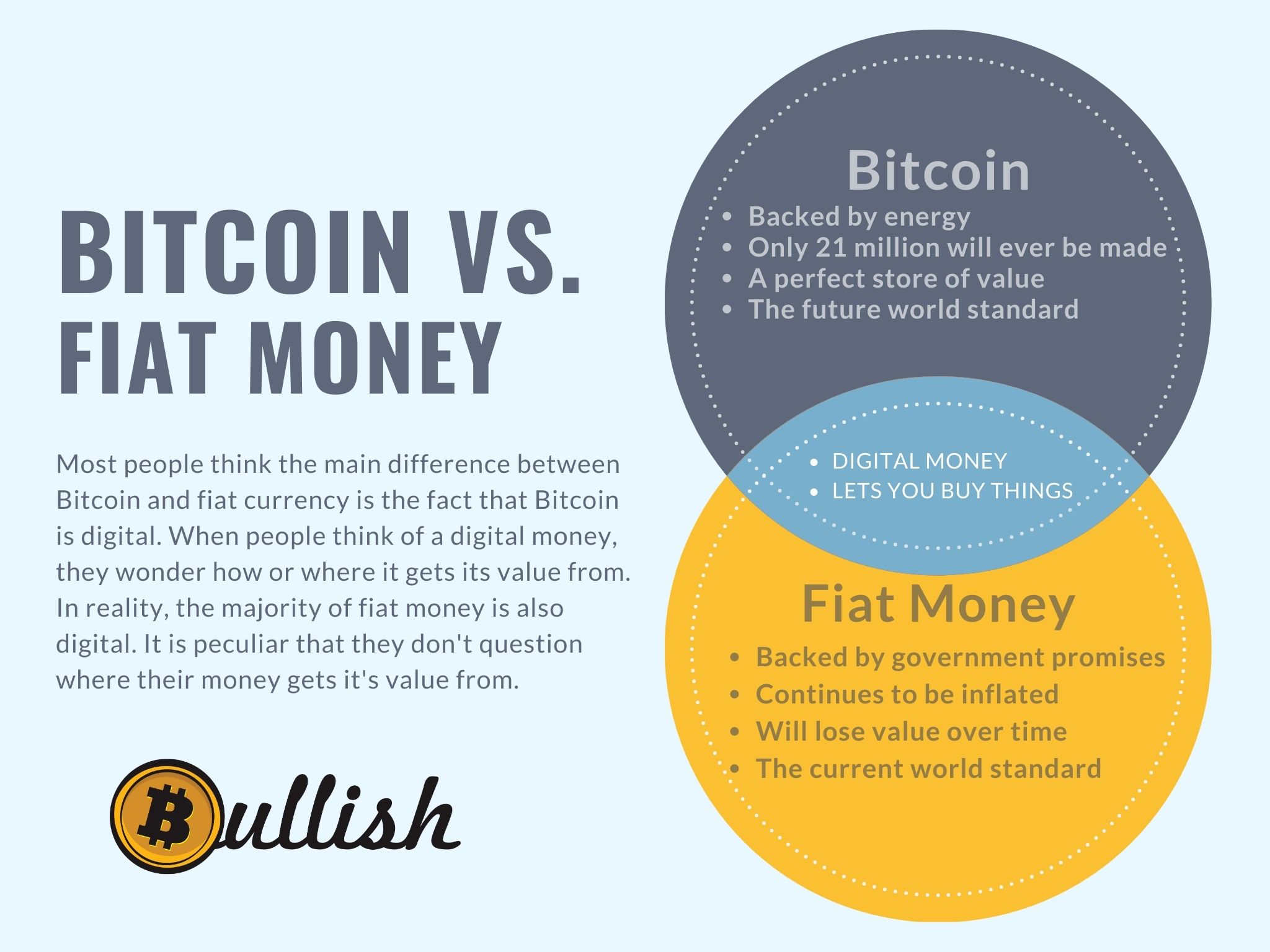

Bitcoin and fiat money both exist digitally. While fiat money does have some physical dollars and coins, this is a small fraction of fiat money. Most fiat money exists in banks or government ledgers. In order to make more fiat money, all the government needs to do is change some numbers in its database. Governments use money printing to give money to people in power while leaving everyone else with less purchasing power, which is known as the Cantillon effect. Banks can also create money out of thin air through the use of fractional reserve banking. Neither of these situations is possible with Bitcoin. No one can magically create more Bitcoin at will. Nor can someone have Bitcoin in their hardware wallet and simultaneously loan the same Bitcoin to others. These corrupt systems of inflation using fiat money are not possible with Bitcoin.

If you enjoyed this article and would like to support this site

Bitcoin is freedom, Banking is slavery.

-Arif Naseem

“When I first heard about Bitcoin, I thought it was impossible. How can you have a purely digital currency? Can’t I just copy your hard drive and have your bitcoins? I didn’t understand how that could be done, and then I looked into it and it was brilliant.”

Jeff Garzik

Related Articles

Henry Ford’s Financial Vision and Nikola Tesla’s Machine Intelligence: The Convergence in Bitcoin

Introduction The dawn of the 20th century witnessed groundbreaking strides in industrial and technological advancements, primarily led by Henry Ford in manufacturing and Nikola Tesla in electrical engineering. While Ford revolutionized the automotive industry with his...

The Genesis of Bitcoin: Revolutionizing Digital Currency

Introduction: Bitcoin has emerged as a groundbreaking digital currency, reshaping our understanding of financial transactions in the digital age. Its creation by the enigmatic figure Satoshi Nakamoto marks a pivotal moment in the quest for a decentralized currency....

Henry Ford

Henry Ford: Henry Ford, the revolutionary industrialist who founded the Ford Motor Company and fathered modern assembly lines, was also a critical thinker when it came to the economic systems of his time. He was famously critical of the centralized banking system,...