What is an Altcoin

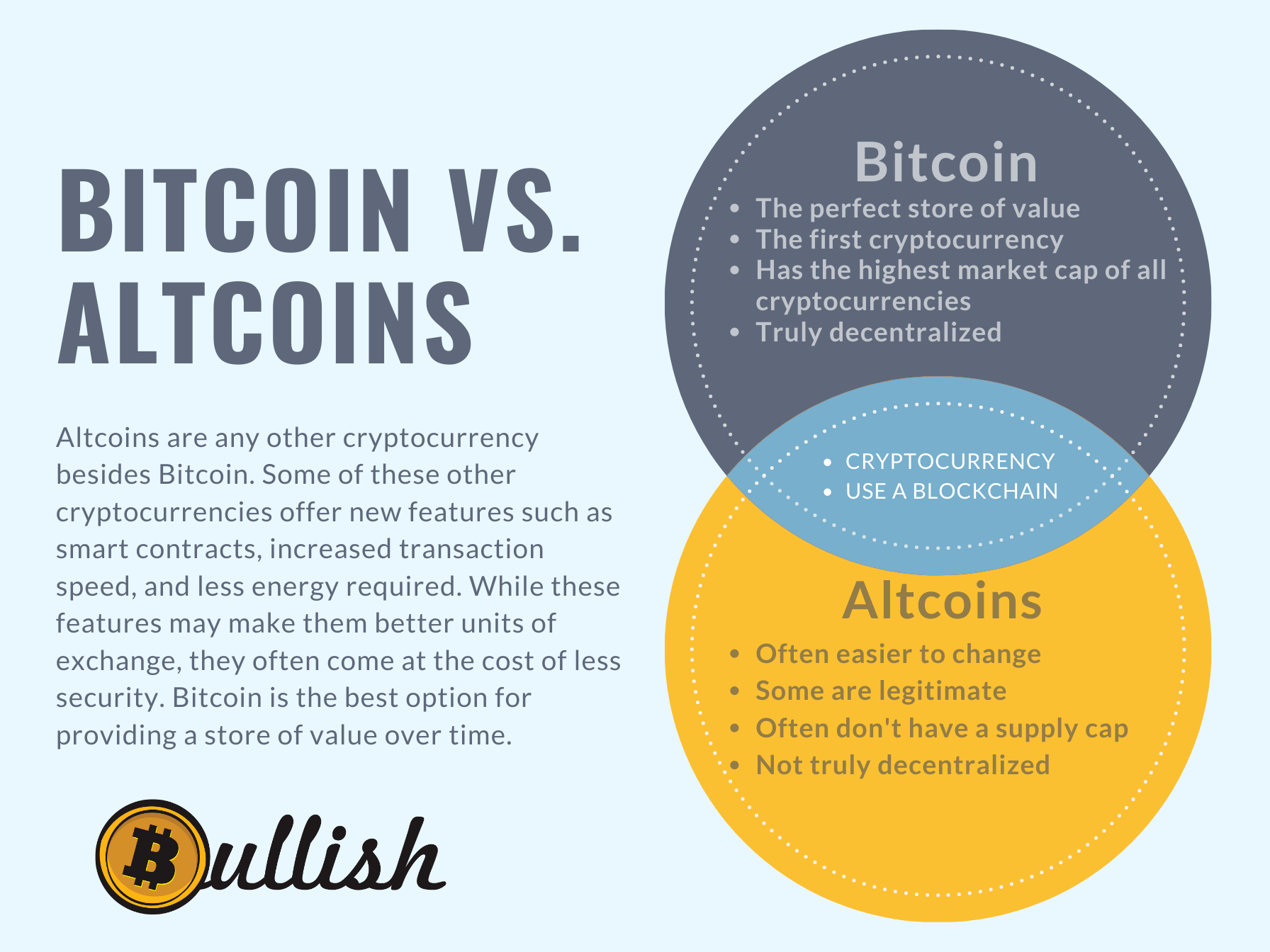

“Altcoin” is a term used for any other cryptocurrency that does not include Bitcoin. Bitcoin was the first mainstream cryptocurrency on the market, but that’s far from the only reason for its success compared to all others. As Bitcoin grows in popularity, imitations and spin-offs of Bitcoin have emerged. Some of these alternative coins have genuine innovation while others are nothing more than scams. Despite any perceived threats, Bitcoin has unique properties that cannot be replicated by altcoins, such as network effects, recognizability, Lindy effects, proven reliability, and immutable and sound monetary policy.

What makes Bitcoin stand out from Altcoins

For the sake of this article, we will ignore the coins which are complete scams. Developers of altcoins wanted to make their own digital currencies for a number of reasons. Some developers thought that they could do what Bitcoin did, but better. Better could mean faster transactions, cheaper transactions, or new features. As we will explain later in the article, these are changes that make better payment methods, but these very changes also make them worse at being a store of value. Bitcoin’s base layer and principle rules will never be changed. Critics will say that this makes it slow and inflexible to the changes of the future, but these are the very characteristics that make it such a great store of value. Imagine gold could just be doubled in supply because there is a war that needs to be funded. This is what fiat money does and it is a terrible system to store value.

First Mover Advantage & Recognizability

Being the first successful cryptocurrency, Bitcoin has a significant advantage in terms of its history, community, and network size. Its 12-year history has attracted top developers and built a large, diverse community. Its network, consisting of tens of thousands of nodes worldwide, is larger than any other cryptocurrency in terms of hash rate, market capitalization, and volume. This dominance in the industry has established a recognizable brand for Bitcoin, making it stand out among the many similar altcoin names and logos.

LIndy Effect & Reliability

Bitcoin is a digital currency that has been in existence since 2009. It’s the first decentralized cryptocurrency, meaning that it is not controlled by any government or institution. Since its launch, Bitcoin has demonstrated an unparalleled level of uptime, remaining active and accessible without interruption. This level of reliability is unmatched by even the most well-established technology companies such as Google, Microsoft, and Facebook. Despite facing numerous challenges such as external attacks, attempted bans from governments, and internal disputes over its direction, Bitcoin has remained resilient and continues to be widely adopted.

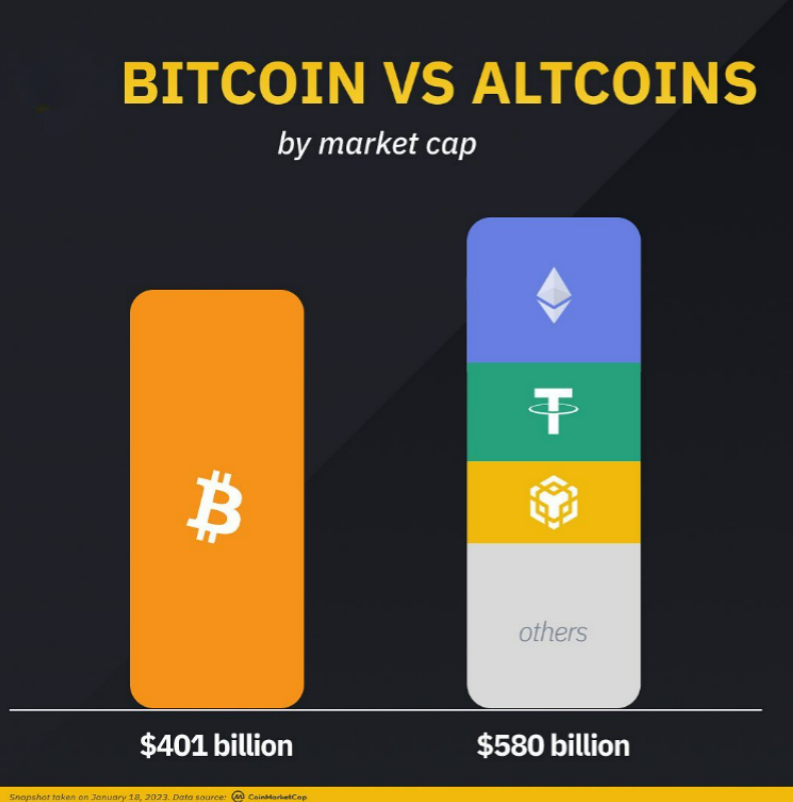

One of the key features of Bitcoin is its volatility, which has been a major factor in its price movements. However, over time, the volatility of Bitcoin has declined, and it has experienced both massive price climbs and drops. Despite this, it has remained the most widely used and well-known cryptocurrency, with a market capitalization that is significantly larger than any other digital currency.

Robustness

Bitcoin has come a long way since its creation in 2009. At its inception, it had a central leader, a single point of failure. However, over time, the creator Satoshi Nakamoto yielded control of the project to a more decentralized group of early developers, setting in motion a trend of decentralization that has continued till today. Today, the Bitcoin network is comprised of thousands of nodes and an unknown number of miners, making it impossible to shut down at any government or leader’s whim.

In terms of technology, Bitcoin has also made significant strides. Syncing the full blockchain has become faster, transaction throughput has increased, and various scaling and privacy solutions are being developed. As patents on signature verification and aggregation schemes expire, Bitcoin is integrating these superior methods. Additionally, bugs in the code have been discovered and fixed, and the community has been working on building more tools and educating developers to contribute to Bitcoin’s codebase and related projects.

Bitcoin has also shown resilience in the face of social and political trials. In 2013, when the Silk Road was shut down by the U.S. government, Bitcoin not only resist being shut down, but it gained attention and adoption. Despite predictions that the network’s hash rate would drop, triggering a price drop and a downward spiral, or that a fork of Bitcoin would destroy its network effects, none of these fears have been realized, and Bitcoin has continued to grow stronger.

The fact that Bitcoin has been around for over a decade is noteworthy. It’s the only cryptocurrency that has been in existence for this long, and its longevity serves as a positive signal to many investors, developers, and former critics. The fact that it has survived for so long despite facing numerous challenges is a testament to its resilience and the potential it holds for the future of digital currencies.

Bitcoiners have confidence that no other cryptocurrency can surpass it thanks to its fair and unchangeable monetary policy. This is a feature that cannot be improved upon by any other technology. While Bitcoin is primarily known for its innovation in money, it also has a secondary impact on payment methods. However, it’s important to note that what makes a good payment method differs from what makes a good store of value. Payment methods should be fast, inexpensive, and widely accepted. As for a store of value, it should retain its worth over time and across borders, and Bitcoin excels in this area compared to any other asset, including other cryptocurrencies. This is thanks to its set monetary policy which states that there will never be more than 21 million Bitcoins. From an economic standpoint, this makes Bitcoin a worthwhile investment and a reliable form of money.

The monetary policy is upheld by the large network of nodes worldwide, each verifying every transaction on the Bitcoin network. Unlike a central bank’s monetary policy which can be changed by a vote, changing Bitcoin’s monetary policy would require the consensus of all nodes on the network, making it almost impossible to happen. While various other digital currencies have copied Bitcoin’s maximum coin limit, including those that have branched off from it, only Bitcoin’s cap can be deemed truly trustworthy. Only Bitcoin can truly assert its decentralization. This is thanks to the sheer number of different individuals/computers who are able to run their own nodes or serve as Bitcoin miners. A digital currency that is centralized in nature cannot confidently establish a hard cap as the governing body in charge has the ability to alter it at any given moment.

Lastly, one of the most important distinctions of Bitcoin from other cryptocurrencies is the fact that Bitcoin is truly a decentralized network. Most altcoins riding on the coattails of BTC will claim that they are decentralized, but this is almost never the truth. Read part I and part II of this article to learn the in-depth truth about decentralized finance

Bitcoin vs. Altcoins in Summary

In summary, Bitcoin is the first and most well-established cryptocurrency on the market, and it has several unique properties that set it apart from altcoins. Firstly, Bitcoin has a significant first-mover advantage and recognizability, with a 12-year history and a large, diverse community. Secondly, Bitcoin has proven to be a reliable store of value, with an unparalleled level of uptime, and resilience despite facing numerous challenges. Thirdly, Bitcoin is decentralized, making it impossible for any government or leader to shut down, and it has made significant technological advancements. These characteristics, such as network effects, Lindy effects, reliability, and robustness, make Bitcoin stand out among the other alternative coins.

Bitcoiners have confidence that no other cryptocurrency can surpass it because of its fair and unchangeable monetary policy, which is a feature that cannot be replicated by any other technology. Bitcoin’s monetary policy, which states that there will never be more than 21 million Bitcoins, makes it a worthwhile investment and a reliable form of money. Additionally, the monetary policy is upheld by a large network of nodes worldwide, making it almost impossible to change. This makes Bitcoin stand out as a store of value, compared to other assets including other cryptocurrencies, as it is able to retain its worth over time and across borders.

This is not to say that some other cryptocurrencies don’t have their own utility and unique functions. If you want to own others, I’d suggest doing plenty of research and constantly asking yourself “what value is it providing to society”. Many of the features that altcoins claim differentiate themselves from Bitcoin are solved on a second layer instead of the base layer. For example, quick and cheap transactions are solved by the Lightning Network. Ultimately, if you are looking for an asset that provides a great store of value over time, I wouldn’t look any further than Bitcoin.

“Bitcoin is a technological tour de force.”

-Bill Gates

“Bitcoin, and the ideas behind it, will be a disrupter to the traditional notions of currency. In the end, currency will be better for it.”

Edmund Moy, 38th Director of the United States Mint

Related Articles

Bitcoin vs. Fiat Money

What is Fiat Money? The term, fiat money, is derived from the Latin word fiat, which means a determination by authority. Fiat money is a form of currency that is considered legal tender by a government and is not backed by a physical commodity or financial instrument....

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.