What is Fiat Money?

The term, fiat money, is derived from the Latin word fiat, which means a determination by authority. Fiat money is a form of currency that is considered legal tender by a government and is not backed by a physical commodity or financial instrument. It includes paper money and coins, as well as money in the form of loans, bonds, and credit. 95% of all fiat money is not physical money. It’s mostly accounted for in bank and government ledgers. Examples of fiat money include the US dollar, the Euro, or the Japanese Yen.

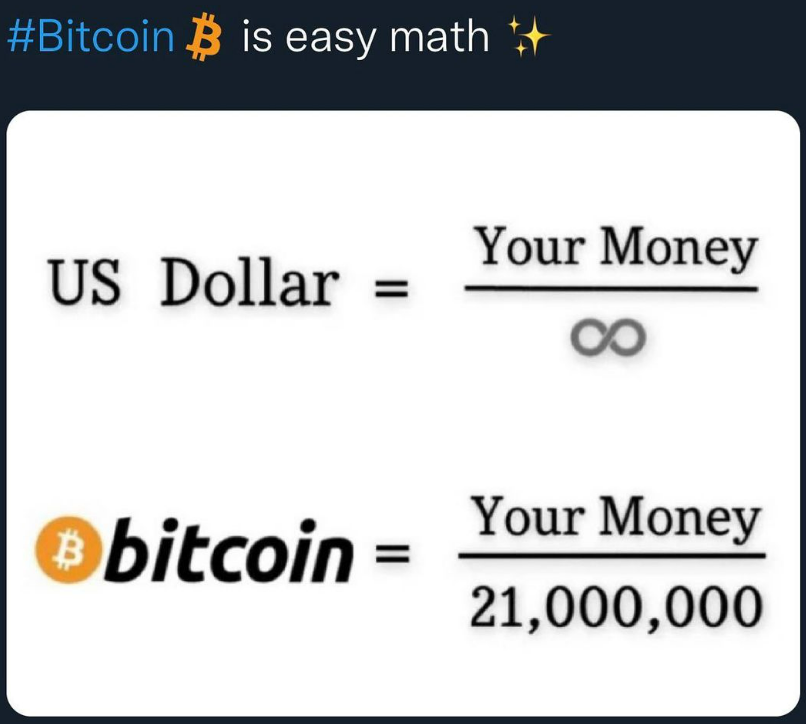

Fiat money’s value is determined by the government and the stability of the nation’s economy rather than the material it is made of. After the U.S. abandoned the gold standard in 1971, fiat money became the norm. However, because it is not tied to gold, it is at risk of inflation and loses value as the government prints more money. Before 1971, the global economy operated on the gold standard, where individuals could exchange their money for a fixed amount of gold. Countries that followed the gold standard established a fixed price for gold, which was used to determine the value of their currency. This meant that the amount of money in circulation was directly linked to the country’s gold reserves. Now that the world is off the gold standard, governments can print money without any real value added to the economy.

Banks can also create more fiat money out of thin air. They do this through fractional reserve banking. This is where banks can loan out a significant portion of the money that people give to them. Watch this quick video to get an idea of how this contributes to inflation.

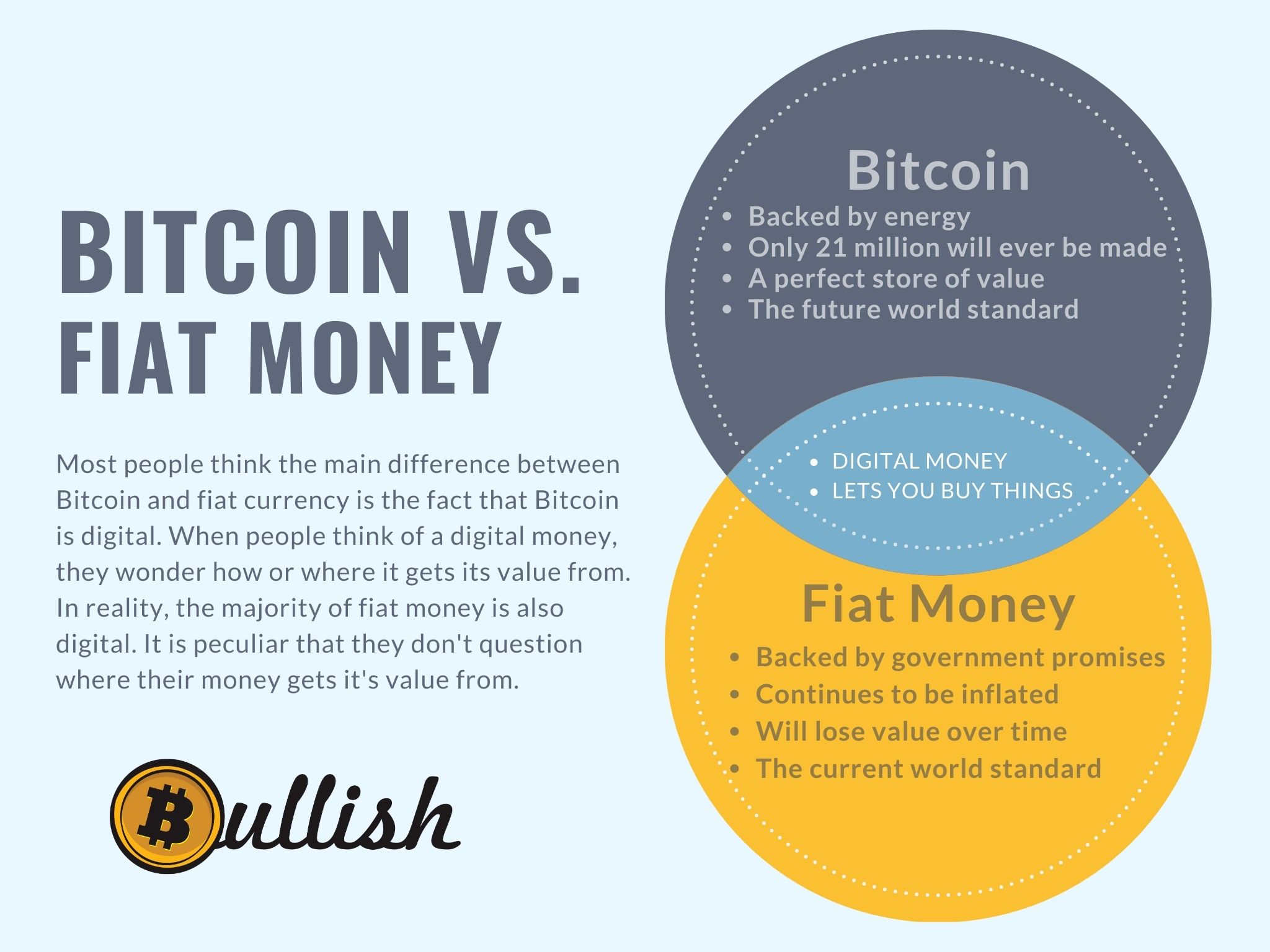

How is Bitcoin Different?

Bitcoin doesn’t have a government or a small group of people who get to make the rules. The value of Bitcoin is not determined by a government, it’s determined by everyone who chooses to buy or sell it. Bitcoin is much more similar to the gold standard than it is to fiat money. Gold requires work, specialized equipment, and energy to mine from the ground. There is a limited amount of gold in the Earth’s crust. To mine Bitcoin, one must have specialized computers which solve complicated mathematical problems. This process requires energy. There are only twenty-one million Bitcoin that will ever exist. Every four years, the amount of Bitcoin rewarded to these mining computers is cut in half. So in reality it’s becoming harder to make more Bitcoin.

Critics of Bitcoin argue that it isn’t backed by anything. They think that because it’s digital, it has no inherent value. They worry that because it isn’t controlled by a government, there is no one to defend it. Let’s respond to each of these three concerns separately.

What is Bitcoin backed by?

Bitcoin is backed by energy and cryptography. Energy is required to run the mining computers which are solving cryptography problems. Cryptography is the practice and study of techniques for secure communication in the presence of adversarial behavior. This is where the term “crypto” comes from. Miners compete to find the solution to a complex mathematical problem, which involves finding a specific value that meets certain criteria. The miner who finds the solution gets to add the next block to the blockchain and is rewarded with newly minted Bitcoins. As mentioned, this process requires a significant amount of energy. This energy input is Bitcoin’s tether to real-world value. Without energy flowing into the Bitcoin network, it wouldn’t be secure and it wouldn’t have any real-world thing backing its value.

How can Bitcoin have value if it’s digital?

We just explained what Bitcoin is backed by in the section above. To dive deeper into this concern of Bitcoin being digital, I’d turn and ask the same question about the digital money that we keep stored on our debit cards. Some may answer that you can go to the bank and withdraw physical money. I’d then ask what this money is backed by and refer you to this very article. The irony of this initial question about Bitcoin being digital is that there is plenty of value for money being digital. This is why we spend money with debit cards in the first place. It’s extremely portable and can be sent around the world at nearly the speed of light. To answer this question, yes there is actually added value to money being digital by its nature. There is full transparency and accountability thanks to Bitcoin’s decentralized ledger.

Who is going to defend Bitcoin if it isn’t controlled by the government?

Bitcoin doesn’t need to be defended. Bitcoin isn’t trying to keep people out. Bitcoin isn’t waging a war against any other country. It’s a voluntary peer-to-peer network that offers a new way of storing and sending wealth. Bitcoin doesn’t change as the world changes. It just keeps doing its own thing, a plan set in motion by Satoshi Nakomoto over a decade ago. Bitcoin has had countries ban it along with countries who now accept it as legal tender. Bitcoin doesn’t need you to defend it, but it welcomes anyone who is looking for another option from the fiat standard we live in today.

Bitcoin vs. Fiat in Summary

Bitcoin and fiat money both exist digitally. While fiat money does have some physical dollars and coins, this is a small fraction of fiat money. Most fiat money exists in banks or government ledgers. In order to make more fiat money, all the government needs to do is change some numbers in its database. Banks can also create money out of thin air through the use of fractional reserve banking. Neither of these situations is possible with Bitcoin. No one can magically create more Bitcoin at will. Nor can someone have Bitcoin in their hardware wallet and simultaneously loan the same Bitcoin to others. These corrupt systems of inflation using fiat money are not possible with Bitcoin.

If you enjoyed this article and would like to support this site

Bitcoin is freedom, Banking is slavery.

-Arif Naseem

“When I first heard about Bitcoin, I thought it was impossible. How can you have a purely digital currency? Can’t I just copy your hard drive and have your bitcoins? I didn’t understand how that could be done, and then I looked into it and it was brilliant.”

Jeff Garzik

Related Articles

The Genesis of Bitcoin: Revolutionizing Digital Currency

Introduction: Bitcoin has emerged as a groundbreaking digital currency, reshaping our understanding of financial transactions in the digital age. Its creation by the enigmatic figure Satoshi Nakamoto marks a pivotal moment in the quest for a decentralized currency....

What is Bitcoin?

Bitcoin was the first cryptocurrency to be widely adopted around the world. It can be sent securely and directly between people using Bitcoin's network. In 2008, Satoshi Nakamoto, who wrote a white paper describing the technology, created Bitcoin under a pseudonym....

Unspoken Injustices of the World: IMF & World Bank Edition

Imagine you could make money out of thin air. Now imagine you could loan this free money to someone who desperately needs it and require them to pay it back with interest. On top of this, you get to dictate how they use this money along with how they live their life....

You’re Not Too Late

I think every person who takes time to learn about Bitcoin has the same initial thought, “If I had only invested in bitcoin a few years ago, I’d be rich.” While this is likely true, this shouldn’t stop you from investing in it now. The next thought that goes through...

Bitcoin & Freedom Go Hand in Hand

Freedom is a Responsibility and a Moral Obligation Owning Bitcoin allows you to be in control of your own financial affairs, similar to the responsibility of maintaining freedom. However, it is important to keep in mind that this responsibility also requires taking...